maryland student loan tax credit 2020

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. From July 1 2022 through September 15 2022.

Maryland Relief Act Of 2021 What Taxpayers Need To Know Now Sc H Group

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents.

. Maryland Student Loan Debt Relief Tax Credit 2020. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

If you qualify for the federal earned income tax credit and. Larry Hogan spoke at the Annapolis Summit Wednesday Jan. The Maryland student loan debt relief tax credit came in effect in July 2017 by the MHEC.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. You have incurred at least 20000 in total undergraduate andor graduate student loan debt. Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt Main_Content Governor Larry Hogan and Maryland Higher Education Commission.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of. AnswerThe tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward.

Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt Main_Content Governor Larry Hogan and Maryland Higher Education. From the last three years the state of the United States of America has allocated funds. The Student Loan Debt Relief Tax Credit is a program created under 10.

Student Loan Debt Relief Tax Credit for Tax Year 2021. Student Loan Debt Relief Tax Credit Application. You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. For Maryland Residents or Part-year Residents Tax Year 2020 Only. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference.

Will have maintained residency within the state of Maryland for the 2020 tax year Have. Instructions are at the end of this application. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Hogan announces 9M in tax credits for student loan debt By. If the credit is more than the taxes you would otherwise owe you will receive a tax.

Associated Press January 13 2020 Gov. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Student Loan Debt Relief Tax Credit for Tax Year 2020.

The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. Student Loan Debt Relief Tax Credit Program. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at.

Governor Larry Hogan Official Website For The Governor Of Maryland

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Maryland State 2022 Taxes Forbes Advisor

Maryland 529 Plan And College Savings Options Maryland 529

Comptroller Of Maryland Facebook

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Best International Student Loans For Visa Holder And Students International Student Loans International Students Student Loans

If You Are A Maryland Resident Maryland Resident Income

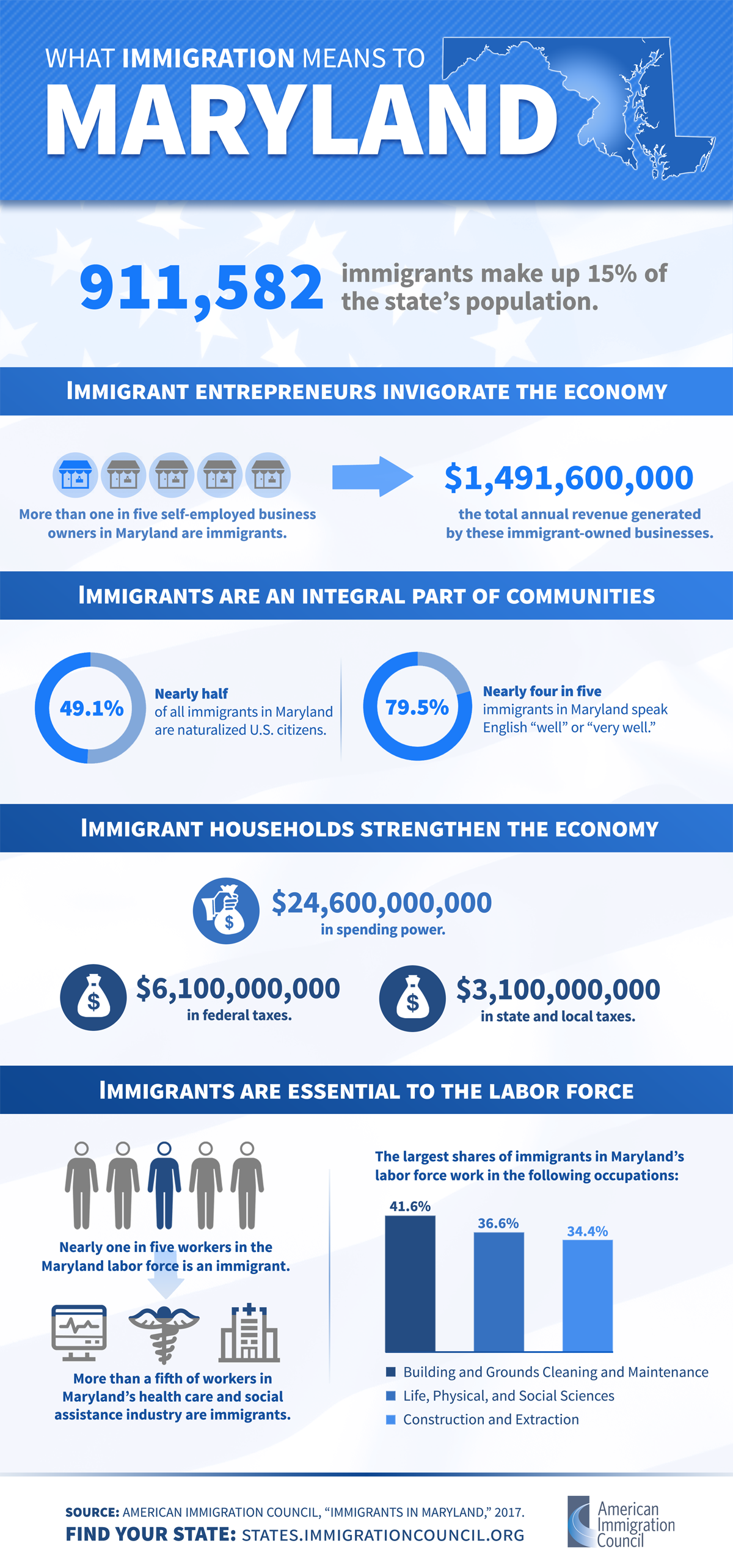

Immigrants In Maryland American Immigration Council

Maryland Relief Act For Individuals And Businesses Glass Jacobson Financial Group

Pages Income Tax Credit For Preceptors

Working As A Paralegal Before Law School Is Worth It Sometimes Law School Paralegal Law Student

Deal B2g2 Free T Mobile 11 18 11 20 2016 Future Proof M D How To Plan Personal Finance Free

Maryland Relief Act Grants Baltimore Gas And Electric Company

Maryland First Time Homebuyer Home Buying Maryland First Time