ct sales tax online

Sales Use Tax Filing information. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

Should You Be Charging Sales Tax On Your Online Store Backoffice

AU-866 Form used to request a clearance.

. Business tax information for Connecticut employers. Connecticut has a 635 statewide sales tax rate and does not allow local governments. City Total Sales Tax Rate.

Multiply the applicable gross receipts by 8425 for services on or after July 1 2011 and enter the result on Line 74 Column B. Attorney Occupational Tax Beverage Container Business Entity Tax Electronic Generation Tax Return Hospital Net Revenue Nursing Home User Fee Resident Day User Fee Tax. Amston CT Sales Tax Rate.

See Tutorials and FAQs. Since municipalities and their attorneys cannot. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax.

All have a sales tax. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Andover CT Sales Tax Rate.

Ansonia CT Sales Tax Rate. Either your session has timed-out or you have performed a navigation operation Ex. Connecticut State Department of Revenue Services.

Lets start with the basics of ecommerce sales tax. Connecticut Department of Revenue Services - Time Out. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Obtain tax clearance - business only. IP 2018 10 Successor Liability and Request for Tax Clearance. Several examples of exceptions to this tax are certain types of safety gear some groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent.

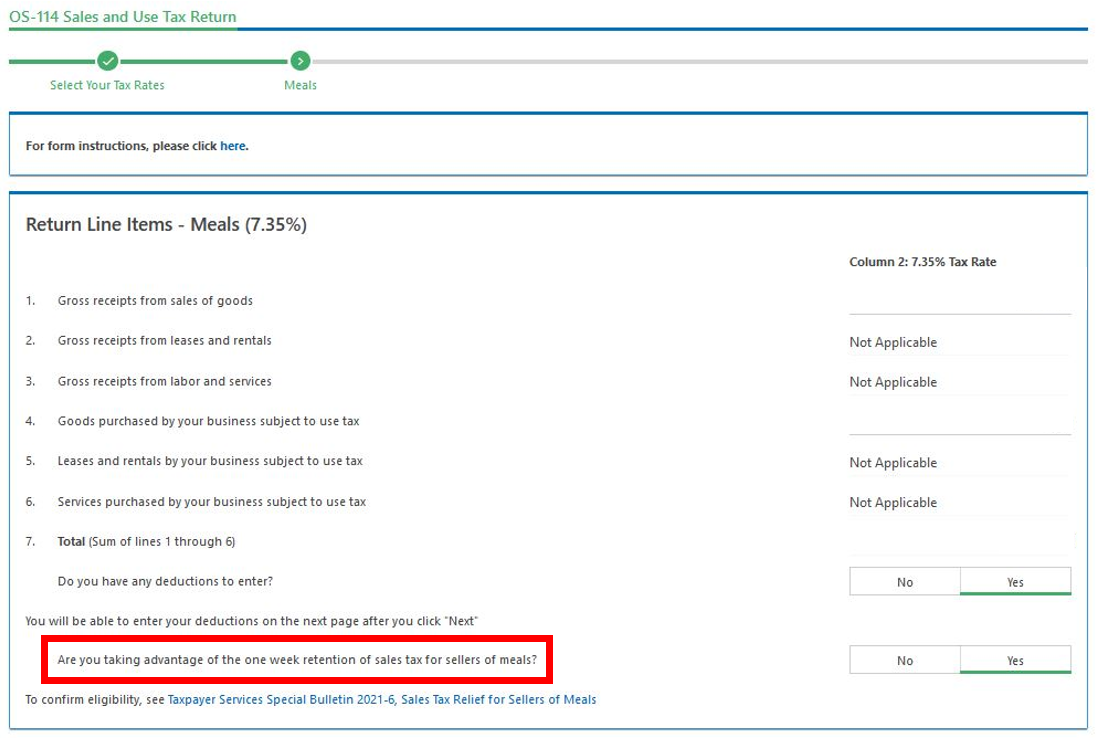

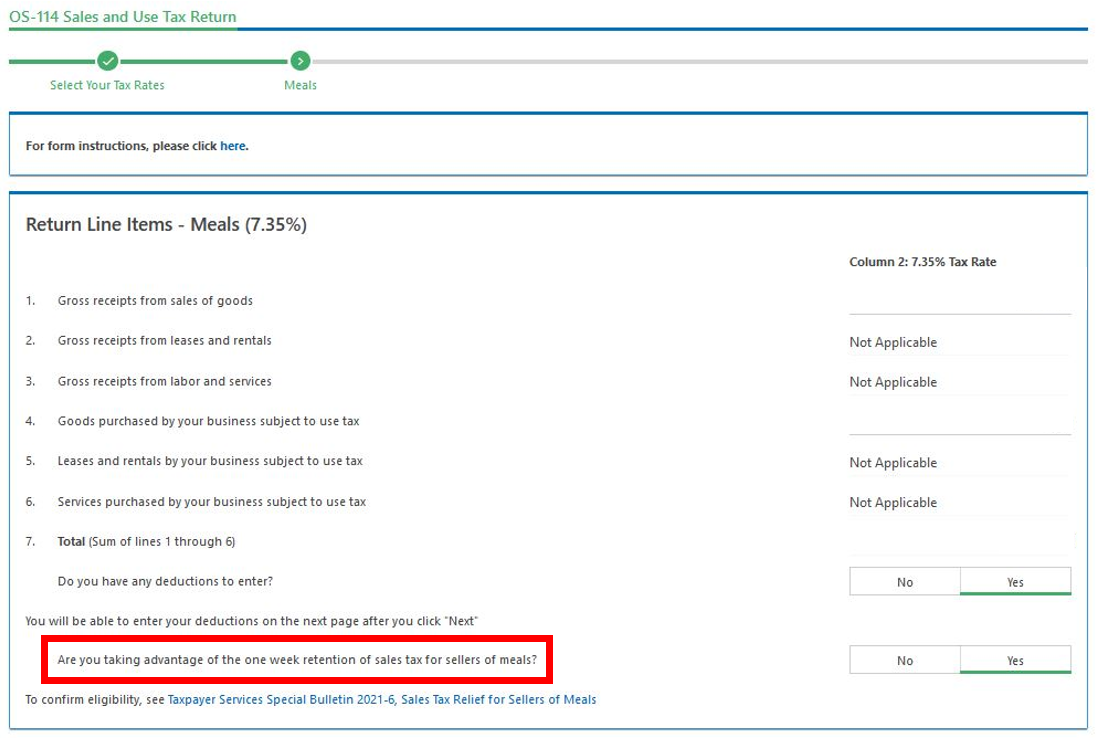

Please go to Connecticut Taxpayer Service Center to re-login to the system. Change Administrator TPG-189 Subscribe to e-alerts. Report the total gross receipts of the sale of computer and data processing services on Line 3 of Form OS-114 Sales and Use Tax Return.

Then follow the instructions for Line 74 of the return. You can use our Connecticut Sales Tax Calculator to look up sales tax rates in Connecticut by address zip code. Sales tax is a small percentage of a sale tacked on to that sale by an online retailer.

Acts 106 65 10292021. Commissioner Boughton Issues Guidance on Peer-to-Peer Car Sharing 2021 Conn. No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in Connecticut.

See Available Tax Returns. Connecticut Department of Revenue Services Reminds Sellers of Meals of Sales Tax Relief 12012021. Sales and Use Taxes - Nexus.

In the state of Connecticut sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Connecticut state sales tax rate is 635. Find out where your business may have created nexus with just three questions.

Exact tax amount may vary for different items. The 2021 CT Tax Amnesty Program offers a limited opportunity to make it right. 2022 Connecticut state sales tax.

Department of Revenue Services. Sales tax relief for sellers of meals. Using Back Button of the browser that is not understood by the CT Taxpayer Service Center application.

MyconneCT is the new Connecticut Department of Revenue Services DRS online portal to file tax returns make payments and view your filing history. Report a lost or stolen check. Disclaimer This webpage and its contents are for general informational use only and are not legal advice.

The same goes if you have nexus in Connecticut because you sell on FBA. Looking for something specific. A tax at the general rate of 635 is imposed by the state on most sales of tangible personal property and on most services enumerated in Section 12-407 of the Connecticut General Statutes.

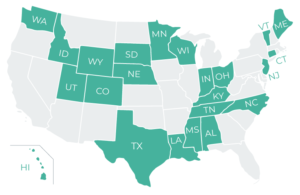

Anyone engaged in business in Connecticut which includes selling tangible personal property for storage use or other consumption in this state or selling taxable. Ad Most states now require out-of-state sellers to collect and remit sales tax. States and Washington DC.

Abington CT Sales Tax Rate. Integrate Vertex seamlessly to the systems you already use. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635.

Enter business name business ALEI or filing number. MyconneCT is one part of a multi-year multi-phase information technology IT modernization initiative. This search covers all domestic formed in Connecticut and foreign formed outside of Connecticut entities on record.

We cover more than 300 local jurisdictions across Alabama California Colorado Kansas Louisiana and Texas. Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at retail. There are no local sales tax rates which means that collecting sales tax is easy.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly click here to learn more. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under Connecticut General Statutes 12-157.

Create a Tax Preparer Account. Counties and cities are not allowed to collect. STATE LAUNCHES TAX AMNESTY PROGRAM.

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Where S My State Refund Track Your Refund In Every State

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Relief For Sellers Of Meals

What Is Sales Tax Nexus Learn All About Nexus

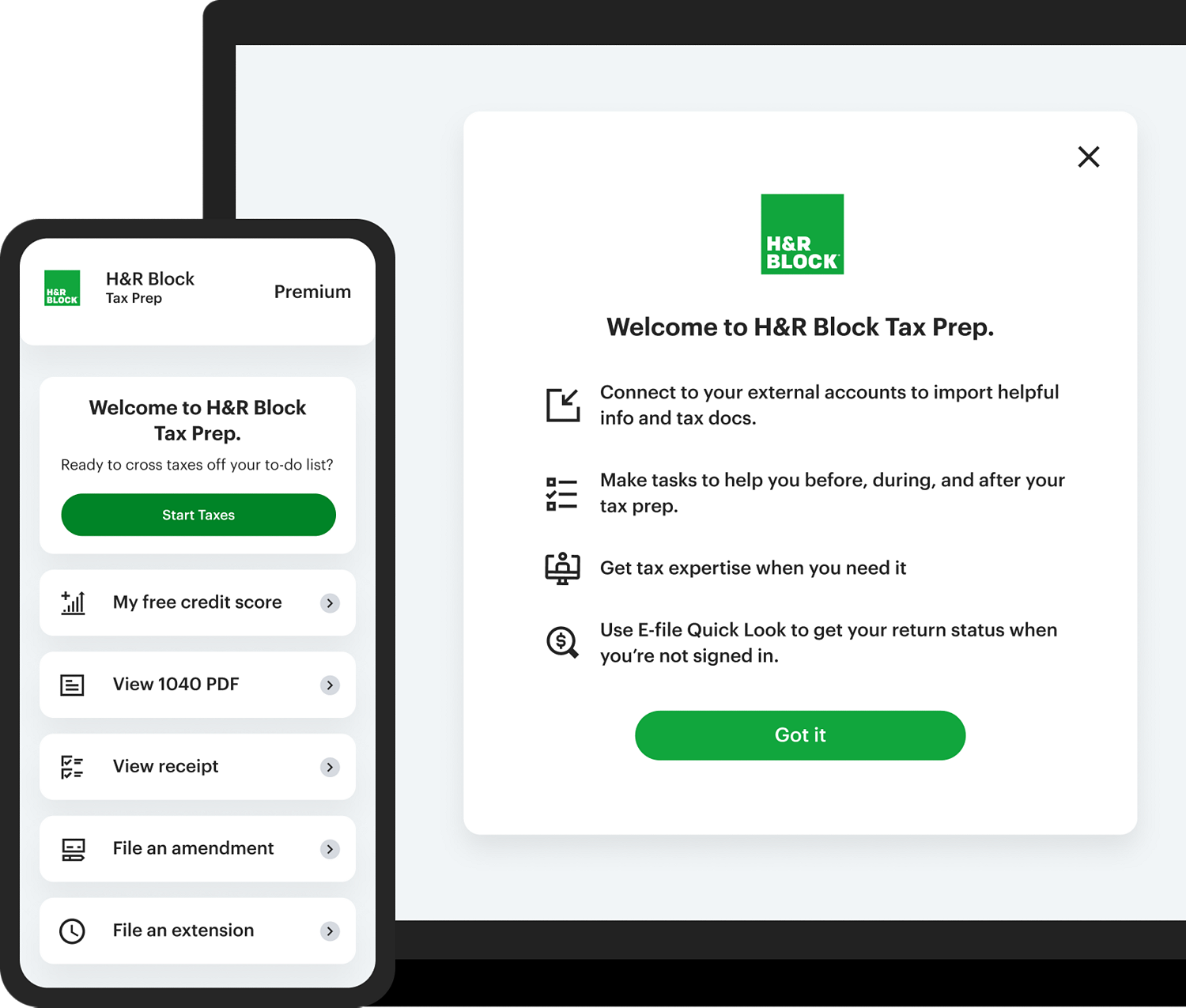

Premium Online Tax Filing And E File Tax Prep H R Block

Ct Senate Republicans Call For Sales Tax Reduction Connecticut Senate Republicans

States With Highest And Lowest Sales Tax Rates

How To Register For A Sales Tax Permit Taxjar

How To Calculate Sales Tax For Your Online Store

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Sales Tax Holidays Politically Expedient But Poor Tax Policy

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation